A recent South China Morning Post report informs that China’s middle-class remains cautious about buying property, despite repeated efforts by the Government of China to loosen household purse strings. According to the university study by researchers at Southwestern University of Finance and Economics in Chengdu, the index of families’ future spending expectations was even lower than the early days of the Covid-19 pandemic. According to data released by China’s National Bureau of Statistics, property investment dropped by 9.8% year on year in the first four months of the year, exceeding the 9.5% drop observed in the first quarter.

The university’s quarterly survey of household wealth and income states that the index of spending expectations fell to 101.9 in the first quarter of this year, down from 103.0 in the fourth quarter of 2023. A reading of 100 is the dividing line between expansion in spending plans and contraction. The latest reading is even lower than the 102.6 result for the second quarter of 2020 when the corona pandemic began to hit the economy.

In an effort to stabilise the crisis-hit property market, China announced “historic” steps in the last week of May 2024 aimed at clearing inventory and boosting homebuyer demand. The package includes cutting down payment requirements and removing the floor for mortgage rates to entice buyers back into the market. Among other things, local governments can now instruct State-Owned Enterprises (SOEs) to purchase completed unsold apartments from property developers and convert them into social housing. More importantly, China’s Central Bank has set up a 300 billion Yuan (US$ 41 billion) re-lending facility, which could result in 500 billion Yuan worth of commercial bank financing for SOE purchases, equivalent to 0.4% of the country’s GDP. Local governments can also re-purchase idle land from developers, which might improve cash flows.

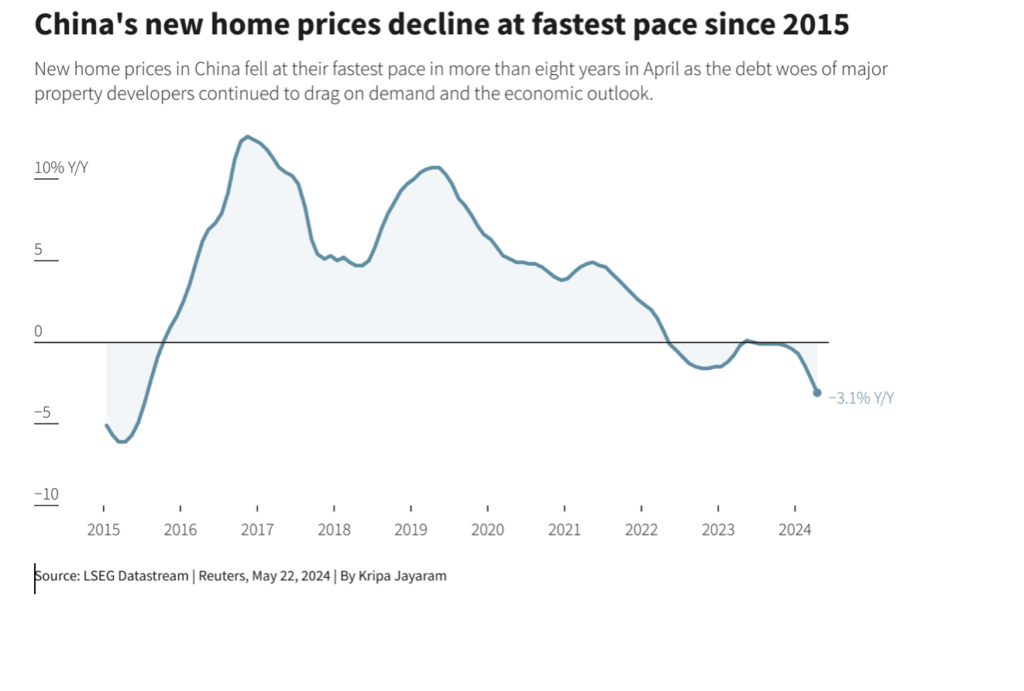

At the beginning of May this year, Beijing additionally relaxed some rules on multiple home purchases as part of efforts to stimulate a stubbornly stagnant property market. Families that reach current ownership limits will be allowed to purchase one more home in the area outside Beijing’s fifth ring road. The easing of the rules came on the same day that new statistics underscored the property market’s continued slump. New home sales in April 2024, by the top 100 Chinese developers, dropped 44.9 per cent year on year to 312.2 billion Yuan (US$ 43 billion), and fell by 12.9 per cent compared with March, according to China Real Estate Information Corporation. The overall Chinese economy registered weaker activity in April 2024, largely owing to the deteriorating property sector and a consumption slowdown.

Families in the survey were particularly cautious about buying real estate, with the proportion of households buying new homes falling to 6.4 per cent in the first quarter of this year from 7.5 per cent in the final quarter of 2023. Only 6.8 per cent of households said they planned to buy property in the next three months, while 20.1 per cent of households said they would take a wait-and-see approach, the survey found. The fall reflected a broader decline in investment in the country’s real estate sector, which fell 9.8 per cent year on year in the first four months of 2024, according to the National Bureau of Statistics. The amount of floor space sold fell 20.2 per cent in the same period. The report on the university’s survey also said that 62.3 per cent of respondents were not optimistic about economic prospects in the next 12 months, down slightly from 66.4 per cent three months earlier.

A further lowering of mortgage rates and promoting property destocking have raised hopes that more supportive policies would be introduced to reduce financial risks and accomplish this year’s economic growth target. China’s GDP expanded 5.3 per cent year on year in the first quarter, with domestic consumption contributing 73.7 per cent to economic growth, according to the National Bureau of Statistics. Retail sales of consumer goods, a major indicator of the country’s consumption strength, rose 4.7 per cent year on year in the first quarter of this year. The survey done by the University’s Survey and Research Centre for China Household Finance measures the spending plans of households with an average of 1.5 million yuan (US$ 207,000) in combined property and financial assets, and an average household income of 170,000 yuan. With exports facing external headwinds and in debt weighing on investment prospects, China has pinned high hopes on consumption helping to drive the economy. However, statistics also show that outlays in discretionary areas such as travel and entertainment have largely remained at pandemic lows, although rising to 99.6 in the first quarter from 97.5 three months earlier.

Expectations of job stability were still in the contraction range below the threshold 100, at 98.3, but better than 95.8 in the previous quarter. Household debt across all income groups rose, particularly among low-income households with an annual income of 100,000 yuan or less. The Southwestern University’s report said the results reflected greater economic pressure faced by these households. It recommends that authorities should consider tax incentives for middle- and low-income families to ease the burden. While the surveyed households showed enthusiasm for investing in precious metals, enrolments in the national private pension scheme launched in November 2022, did not meet policy expectations. By the end of last year, fifty million people had opened personal pension accounts, but only 22% of the account holders had actually made the deposits. About two-thirds of respondents in the Southwestern University’s survey cited a lack of understanding of the policy or concerns about policy changes, and 32.6 per cent were worried about being unable to withdraw investments before retirement or limited tax incentives.

China’s property market thus remains crisis-ridden and while Beijing is going all out to revive this sector, the problem appears to be much deeper. China’s property crisis has been fuelled by years of heavy borrowing by property developers and overbuilding that underpinned much of the country’s remarkable decades-long run of rapid economic growth. The New York Times aptly sums up the situation when it states that the real estate crisis has left many Chinese families, which once poured their life savings into property, without viable alternatives for building wealth. They have few other good options since China’s stock market, remains volatile. It is expected that this volatility will remain. The property market will continue to see a slump in the short to medium term with expectations of recent government measures providing some relief in the long run.