The US government is finding it easier to harass Chinese semiconductor producers than to support its own industry. As the CHIPS Act remains stalled in Congress and Commerce Secretary Gina Raimondo warns that large foreign investments are at risk, tougher US sanctions against China are reportedly in the works.

Congress has been debating for a year and a half but has not yet reconciled the House and Senate versions of the CHIPS Act, which would provide US$52 billion in subsidies to domestic and foreign semiconductor companies that invest in America.

News reports indicate that the US government is putting pressure on the Netherlands to block ASML Holding NV from selling technology used in making a large proportion of the world’s chips to China. The Japanese government is also being prodded by the US to ban Nikon’s sales of similar chip-making technology to China, according to the reports.

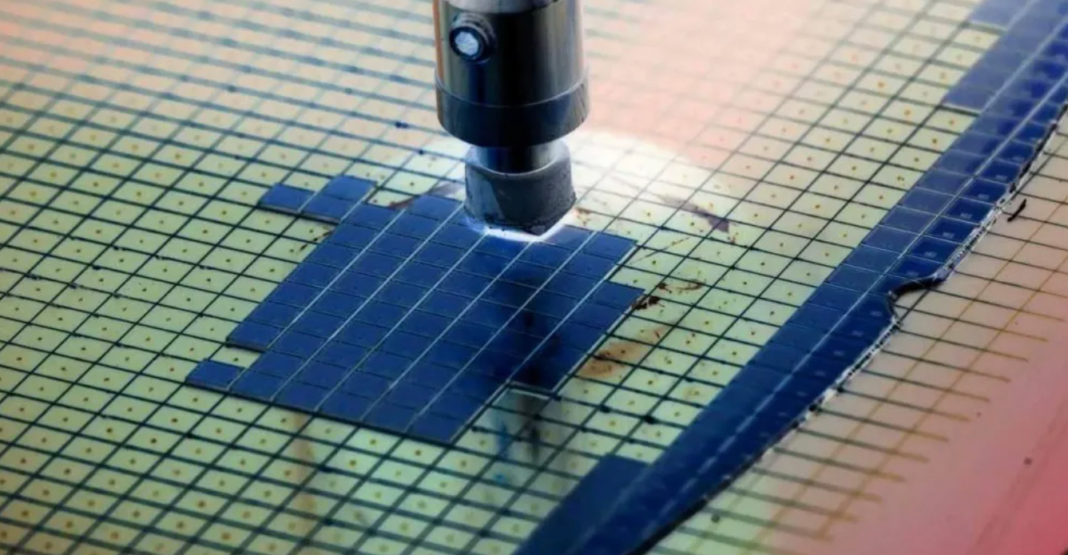

The equipment in question is deep ultra-violet (DUV) lithography tools, which are used in the production of most semiconductors. Lithography is the technology used to transfer semiconductor designs, or circuit patterns, from the photomask to the surface of the wafer for fabrication.

Shipments of extreme ultra-violet (EUV) tools to China were embargoed during the Trump administration. EUV, which has a shorter wavelength than DUV, is used by TSMC of Taiwan and Samsung of South Korea to make chips with the world’s smallest 5-nanometer (nm) and 3-nm design rules.

DUV can be used to make 7-nm chips, but not as efficiently. This leaves China’s SMIC, which tries to compete with TSMC, far behind.

ASML is the world’s dominant producer of DUV lithography tools and the only producer of EUV tools. Nikon does not make EUV tools but is the second-ranked supplier of DUV tools, with US chip-maker Intel as its largest customer. Japan’s Canon also makes DUV tools, but they are not as advanced as Nikon’s.

ASML is the world’s leading DUV lithography tool maker. Image: Twitter

No American companies make DUV or EUV tools. Cymer, an American company acquired by ASML in 2013, supplies the EUV light source.

An embargo of DUV sales to China would be an attack on the entire Chinese semiconductor industry. But it would not – as is sometimes claimed – prevent China from making the many less-advanced semiconductor products it makes now.

Rather, it would make it difficult for China to expand production beyond what will be possible when all the tools delivered up to the implementation of the embargo are installed and operating. That might take an additional two years, some analysts estimate.

As for a new embargo, the Dutch and Japanese may not acquiesce to US pressure. Both have a lot to lose in not selling to China, as do the Americans.

An ASML spokesperson told media that the company was “unaware of any policy change” and added: “The discussion is not new. No decisions have been made, and we do not want to speculate or comment on rumors.” Nikon has not commented.

According to data from the industry association SEMI, sales of semiconductor production equipment (SPE) to customers in China increased by 58% in 2021, accounting for 29% of worldwide sales. That figure includes sales to non-Chinese companies with factories in China.

SPE sales to customers in South Korea and Taiwan rose by 55% and 45% respectively last year, each accounting for 24% of the total. That left Japan, North America, Europe and the rest of the world in single digits.

In the five years to 2021, SPE sales to customers in China increased 4.6 times. That included used equipment, a market that by now has all but dried up. China was the world’s largest buyer of semiconductor production equipment in both 2020 and 2021.

SEMI expects Taiwan to retake the lead this year, but no matter how that turns out, East Asia should continue to dominate the market.

Anti-China American politicians are incensed. Texas Congressman Michael McCaul told the press: “If the Biden administration is serious about securing the semiconductor supply chain in the United States and allied and partner countries, it’s absurd to let the Chinese Communist Party buy up and stockpile the global supply of tools and equipment to make semiconductors.”

US Congressman Michael McCaul wants more blocks on chips to China. Image: Twitter

But Congress is the bottleneck, not the Biden administration, and China’s aggressive capacity expansion has only slightly outstripped demand.

According to market research organization IC Insights, $31.2 billion worth of semiconductors were produced in China in 2021, of which $12.3 billion were made by Chinese companies. The rest came from the local fabs of TSMC, Samsung, Intel and other foreign companies.

In comparison, China consumed $186.5 billion worth of semiconductors in 2021, accounting for 36.5% of the world market. Only 17% of Chinese semiconductor demand was met by production in China and only 7% by Chinese companies. Those figures are likely to increase, but the fact remains that China is an enormous market opportunity for chip-makers.

A year earlier, in 2020, $22.7 billion worth of semiconductors were produced in China, of which $8.3 billion were made by Chinese companies – again according to IC Insights. Total Chinese demand amounted to $143.4 billion and China accounted for 36% of the global market.

Note that total semiconductor production in China increased by 37% in 2021 while production by Chinese companies increased by 48%. Over the past decade, semiconductor production in China has more than tripled.

SEC filings show that six leading American companies, namely Qualcomm, Intel, Texas Instruments, Broadcom, Nvidia and Micron, sold a total of $75.6 billion worth of semiconductors in China in 2021.

That was a 30% increase over 2020, a 50% increase over 2017 and just over 40% of total market demand in China last year. Total American semiconductor sales in China were closer to 50% of total demand.

The figures for the top three American SPE makers – Applied Materials, Lam Research and KLA – show combined sales in China up 44% from 2020 to 2021 and up 3.5 times since 2017 to $14.5 billion.

East Asia will dominate chip-making for the foreseeable future. Image: Twitter

If shipments of Dutch and Japanese DUV lithography tools to China were stopped, shipments of American SPE to China would also be at risk.

As Chinese Foreign Ministry spokesman Zhao Lijian said at a July 6 news briefing, “This will only remind all countries of the risk of being solely dependent on the US in terms of technologies. And it will also prompt them to achieve independence and self-reliance in science and technology at a faster pace.”

When the US sanctioned Chinese tech giant Huawei, semiconductor and SPE suppliers that lost business made up the difference in a booming global market. If new sanctions are launched into a cyclical downturn, however, that will likely not be possible. But Chinese production, supported by a policy of import substitution, will probably continue to grow.

Follow this writer on Twitter: @ScottFo83517667