LAST MONTH, THE Chinese ecommerce giant Alibaba revealed a powerful new cloud computing system designed for artificial intelligence projects. It is used by Alibaba’s cloud customers to train algorithms for tasks like chatbot dialogue and video analysis, and was built using hundreds of chips from US companies Intel and Nvidia.

Last week, the US announced new export restrictions that will make future projects like that unlikely. The Biden administration’s rules forbid companies from exporting advanced chips needed to train or run the most powerful AI algorithms to China.

The sweeping new controls are designed to keep the country’s AI industry stuck in the dark ages while the US and other Western countries advance. The restrictions also block the export of chipmaking equipment and design software, and ban the world’s leading silicon fabs, including Taiwan’s TSMC and South Korea’s Samsung, from manufacturing advanced chips for Chinese companies.

“The United States is saying to China, ‘AI technology is the future; we and our allies are going there—and you can’t come,’” says Gregory Allen, director of the AI governance project at the Center for Strategic & International Studies (CSIS), a think tank in Washington, DC.

Chris Miller, a professor at Tufts University and author of the recent book Chip War: The Fight for the World’s Most Critical Technology, says the new export blockade is unlike anything seen since the Cold War. “The logic is throwing sand in the gears,” Miller says.

The US action takes advantage of a decade-long boom in artificial intelligence in which new breakthroughs have become coupled to advances in computing power. Pioneering new projects often involve machine learning algorithms trained on supercomputers with hundreds or thousands of graphics processing units (GPUs), chips originally designed for gaming but also ideal for running the necessary mathematical operations. That leaves China’s AI ambitions heavily dependent on US silicon.

Baidu, the leading Chinese web search provider and a key player in cloud AI services and autonomous driving, also uses Nvidia chips extensively in its data centers. Last October the company announced one of the world’s largest AI models for generating language, built using Nvidia hardware.

ByteDance, the Chinese company behind TikTok and its counterpart in China, Douyin, relies on Nvidia hardware to train its recommendation algorithms, according to its own software documentation. Several Chinese companies, including Alibaba and Baidu, are developing silicon chips designed to compete with those from Nvidia and AMD, but these all require manufacturing from outside China that is now off-limits. Alibaba and Baidu both declined to comment on the new rules. WIRED did not receive responses to requests for comment made to ByteDance and several other Chinese chip firms.

Big Tech companies in China—as in the US—have made large AI models increasingly central to applications including web search, product recommendation, translating and parsing language, image and video recognition, and autonomous driving. The same AI advances are expected to transform military technology in the years to come, and shape how the US and China butt heads over issues like Russia’s invasion of Ukraine and Taiwan’s claims to independence.

“The Biden administration believes that the hype around the transformative potential of AI in military applications is real,” says Allen of CSIS. “The United States also has a pretty good understanding of which computer chips are going into Chinese military AI systems, and they are American, which is viewed as unacceptable.”

The new export restrictions contribute to the steady decline in US-China relations in recent years, despite decades of technological codependence during which Chinese manufacturing has become the bedrock of the US tech industry. In recent years, the US government has sought to take a more active role in boosting its domestic AI industry and chip production due to an increased sense of competition with China.

Search our artificial intelligence database and discover stories by sector, tech, company, and more.

Shares in several Chinese tech firms, as well as Nvidia and AMD, fell this week as the scope of the restrictions sank in with investors. The Department of Commerce had warned Nvidia and AMD last month that they would have to halt exports of advanced AI chips to China, but the rules announced last week are far broader. The new export rules add to a bruising 18 months for China’s tech firms, after a broad government crackdown aimed at regulating the industry more tightly after years of freewheeling growth.

Being cut off from US chips could significantly slow Chinese AI projects. China’s leading domestic chipmaker, Semiconductor Manufacturing International Corporation (SMIC), produces chips that lag several generations behind those of TSMC, Samsung, and Intel.

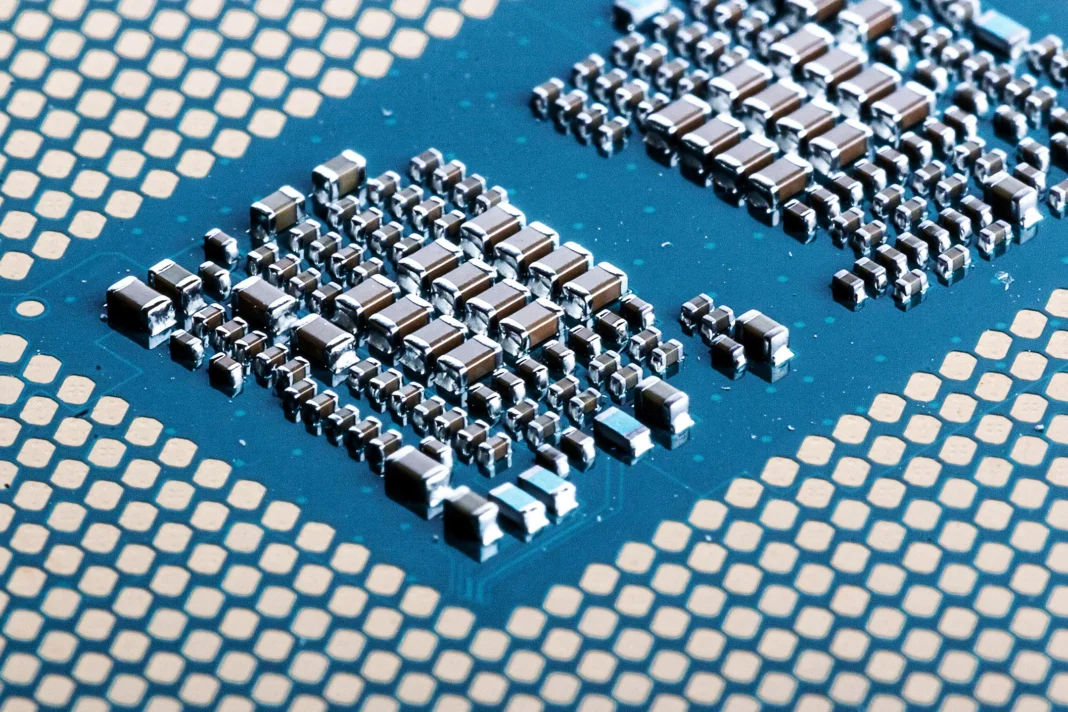

SMIC is currently manufacturing chips in what the industry calls the 14-nanometer generation of chip making processes, a reference to how densely components can be packed onto a chip. TSMC and Samsung, meanwhile, have moved to more advanced 5-nanometer and 3-nanometer processes. SMIC recently claimed that it can produce 7-nanometer chips, albeit at low volume.

The capacity of any Chinese company to keep pace with advances in chip manufacturing is limited by its lack of access to the extreme ultraviolet lithography machines needed to make chips with components smaller than those of the 7-nanometer generation. The sole manufacturer, ASML in the Netherlands, has blocked exports to China at the request of the US government.

David Kanter, president at chip analysts Real World Insights, says that one from the 5-nanometer generation of semiconductor technology is roughly three times faster or more efficient than a 14-nanometer one because of a greater density of transistors and other design improvements.

From artificial intelligence and self-driving cars to transformed cities and new startups, sign up for the latest news.

The move will not cut China’s AI industry off overnight, however. A person at a Chinese venture capital fund that specializes in AI, who spoke anonymously because of the sensitive nature of the topic, says that some Chinese companies have been stockpiling GPU components since parts of the rule change were disclosed in September. It may also be possible for companies to train AI models outside of China using equipment installed elsewhere.

The CEO of a Chinese AI startup, who also spoke on condition of anonymity, said the new restrictions would slow down AI advances at Chinese companies in the long run, but predicted that they could keep up with the US in the short term by running older hardware for longer, making AI models that can do more with the same computing power, or gathering more data. “If the target is to achieve certain accuracy, the amount of data can be more helpful than computational power,” the CEO says. “For most AI tasks, training AI models does not always need huge power.”

The most important question now is how the rules are enforced, says Douglas Fuller, an associate professor at Copenhagen Business School who studies China’s tech industry. “In the short term, I think this will do what it intends to do—kneecap the high performance computing efforts of China,” he says. But Fuller says China will look to other countries that have chipmaking expertise and may try to smuggle components in.