“Strategic ambiguity” has been South Korea’s foreign policy formula for more than a decade. This is because Seoul’s decision not to take a side between Washington and Beijing – given its close economic ties with China and the presence of US military forces in the country – was regarded as inevitable.

The continued tensions between the two superpowers – coupled with other external challenges, including the Covid-19 pandemic, high inflation and the war in Ukraine – have further spurred middle-power and export-oriented South Korea to expedite the diversification of its trade and investment portfolio.

Amid such circumstances, a series of legislative measures initiated by the Biden administration to deter China’s growth at the expense of relations with its allies has prompted Seoul to accelerate its pivot from Beijing.

Additionally, despite China’s reopening after the pandemic, South Korea’s trade deficit with China in the first quarter of this year amounted to US$7.8 billion – the first such deficit since the two countries normalised diplomatic relations in 1992 – causing Korean businesses to reconsider the importance of maintaining a China focus.

Against this backdrop, India has emerged as an attractive destination. Its population is expected to surpass that of China by mid-2023, making it the most populous nation on Earth.

India set to overtake China as the world’s most populous country in 2023, UN predicts

What makes India more desirable is not just the size of its population but the size of its young population. Only 7 per cent of the nation is aged 65 or above, compared to China’s 14 per cent and 18 per cent in the US. The International Monetary Fund forecasts that India’s real GDP growth will reach 5.9 per cent this year, 0.7 percentage points higher than that of China.

Another contributing factor is Indian Prime Minister Narendra Modi’s “Make in India” initiative, aimed to position the nation as a global manufacturing hub, attract foreign investment and integrate it into global supply chains by offering incentives such as simplified regulatory procedures and tax exemptions. Thanks to this effort, launched in 2014, annual foreign direct investment had doubled to US$83 billion as of September 2022, according to government figures.

Furthermore, the Production Linked Incentive scheme Modi announced in 2020 has been extended to eligible companies in key sectors such as electronics, pharmaceuticals, cars and more. The scheme offers companies incentives of 4 to 6 per cent on incremental sales over a base year, for five years, to promote a “self-reliant” India.

Motivated by such incentives and other factors, major Korean and global companies have relocated or enhanced their manufacturing facilities in India. Samsung, beyond building the world’s largest mobile phone factory in Noida, Uttar Pradesh, announced in February that it would manufacture its entire Galaxy S23 smartphone series in India instead of importing them from its factory in Vietnam.

In January, the company touted the launch of its top-of-the-line fridge range that is “100 per cent made in India, with features made for India”. Another Korean electronics giant, LG, revealed in February it would invest US$24 million to establish a new manufacturing line at its Pune-based facility, where it will produce premium side-by-side fridges in addition to those at its existing facility in Greater Noida.

India desperately wants to decouple from China. Here’s why it can’t12 Apr 2023

Electronics companies are not the only players chasing the India boom. Korean steelmaker POSCO, which abandoned its plan in 2017 to set up a steel project in India, announced last year it would construct a steel mill there, this time with an Indian partner, Adani Group, and an estimated investment of up to US$5 billion.

Korean carmaker Hyundai Motor announced it would acquire General Motors’ plant in Maharashtra to expand its manufacturing in India as part of its commitment to launch six electric vehicle models in the country by 2028. This move is expected to help offset the impact of the company’s withdrawal from Russia amid Moscow’s invasion of Ukraine.

Not surprisingly, the Hyundai Motor factory was one of the main stops for Korean Foreign Minister Park Jin during his visit to India last month to celebrate the 50th anniversary of the establishment of diplomatic relations between the two countries. He also underlined the contributions of Korean companies to “Make in India”.

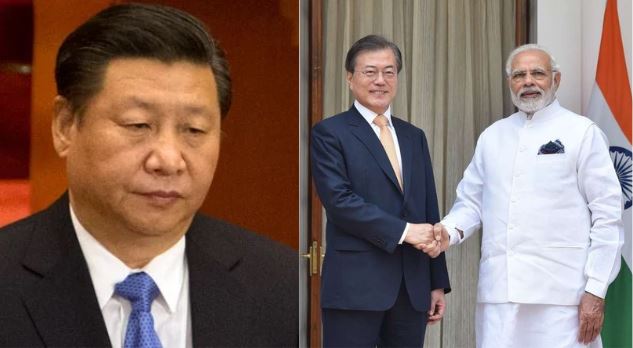

South Korean Foreign Minister Park Jin (left) shakes hands with Indian Vice-President Jagdeep Dhankhar during their meeting in New Delhi on April 7. Photo: DPA

However, there are significant hurdles to foreign investment in India, including deficient infrastructure, an inconsistent regulatory environment and slow bureaucratic processes. A World Bank report last year estimated that US$840 billion is required to upgrade India’s urban infrastructure in the next 15 years as the country becomes increasingly urbanised.

Meanwhile, the World Bank’s Doing Business 2020 report showed India ranked poorly in several key areas, including 136th in ease of starting a business, 154th in registering property and 163rd in enforcing contracts.

Despite the challenges, numerous global businesses are diversifying their supply chains away from China amid growing geopolitical concerns and the ongoing US-China rivalry.

Korean companies are no exception, with many exploring the potential of a rising India as a viable option. China’s economic retaliation against South Korea in 2017 for deploying the THAAD missile defence system on its soil is a painful reminder for Korean businesses of the risks of overdependence on China.

In response, they are willing to tap into the opportunities India presents. As Modi has said, “The whole world is saying that India’s time has arrived.” With South Korea seeking to reduce its reliance on China, we will see an increase in its investments in India, leveraging shared democratic and market systems, and a special strategic partnership.

Haeyoon Kim is a senior programme officer at the Asia Society Policy Institute in Washington, DC

scmp.com