Around 34 percent of Pakistan’s population lives on just USD 3.2 or Rs 588 a day income, the World Bank has said as the cash-strapped country’s new Finance Minister Miftah Isamil faces uphill tasks of containing rising inflation and navigating through one of the worst external sector crisis.

The Pakistan Development Update – the biannual report issued by the Washington-based lender – said that soaring inflation disproportionately affected poor and vulnerable households that spend a relatively larger share of their budget on food and energy, the Express Tribune Newspaper reported on Wednesday.

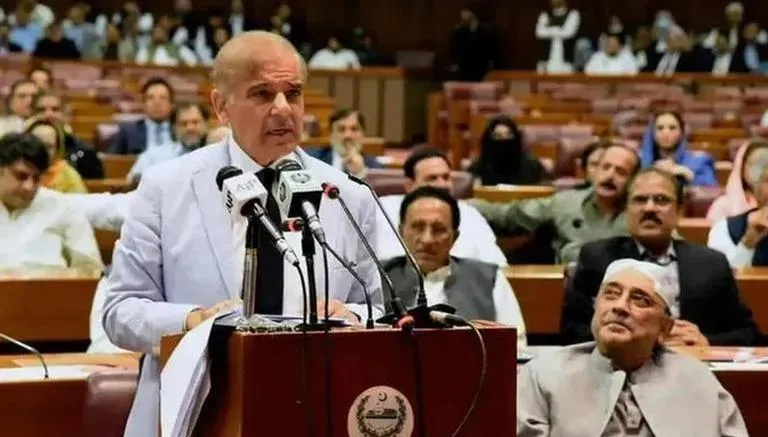

The poor spend around 50 per cent of their total consumption on food items, the World Bank said in the report released on Tuesday, the day Prime Minister Shehbaz Sharif appointed Isamil as the finance minister.

The report pointed out that Pakistan’s key indicators were further deteriorating in the current fiscal year, seeking urgent measures to tighten the fiscal belt for ensuring debt sustainability.

Poverty measured at the lower middle-income class poverty line of USD 3.2 Purchasing Power Parity line of 2011 per day was estimated at 34 per cent in the last fiscal year. The ratio was 37 per cent in the preceding year. But despite a nominal reduction, the percentage was significantly higher and it would be a constraint for the new government that was assigned with an uphill task to ensure economic viability of the country, the report said.

Ismail, along with Dr Ayesha Ghaus Pasha, who has been assigned the portfolio of minister of state for finance would leave for Washington on Wednesday to have their first interaction with the authorities at the US Treasury Department, the International Monetary Fund and the World Bank.

I am hopeful that I will be able to convince the IMF to revive the programme on terms that also take into account harsh ground realities in Pakistan, Ismail was quoted as saying. His one of the most important meetings would be at the US Treasury Department, as the country seeks to repair ties with the world’s largest economy, damaged by immature public statements by former prime minister Imran Khan and former foreign affairs minister Shah Mahmood Qureshi.

But the World Bank’s Pakistan Development Update report tells what lies ahead for the new finance minister.

It cautioned that rising food and energy inflation was expected to diminish the real purchasing power of households, disproportionately affecting poor and vulnerable households that spent a larger share of their budget on these items.

However, with higher inflation, increasing borrowing costs and political uncertainty, business and consumer confidence had been trending lower after reaching a pandemic high in June 2021.

The World Bank said that the inflation was estimated to rise to an average of 10.7 per cent in fiscal year 2021-22 as against the target of 8 per cent, reflecting higher oil and commodity prices. Headline inflation in Pakistan was the highest in South Asia, where the regional average was 6 per cent during the first half of the current fiscal year. Energy inflation reached 25.1 per cent on a yearly basis in urban areas and 22.6 per cent in rural areas in the current fiscal year.

The World Bank report underlined that given the current significant imbalances in the external sector and low external buffers, macroeconomic adjustment, specifically fiscal consolidation to complement ongoing monetary tightening, was urgently needed.

Heightened domestic political uncertainty over the past few months had slowed the implementation of key reforms to improve overall fiscal and debt sustainability. Going forward, further policy reform slippages and delays in adjustment measures were likely to exacerbate the already widening macroeconomic imbalances, it said.

Meanwhile, the IMF has kept its growth forecast for Pakistan unchanged at 4 per cent for fiscal year 2022, though it noted that near-term risks from rising inflation and a changing external environment had increased and sharply revised the Fund’s projections for the country’s current account deficit and inflation.

It now expects the current account deficit to rise to 5.3 per cent of GDP by end-June 2022, from a previous forecast of 4.1 per cent, mainly due to imports of oil and commodities. In the World Economic Outlook released in Washington, the IMF projected Pakistan’s current account deficit to hit USD 18.5 billion this fiscal year. Previously the Fund had projected a deficit of USD 12.9 billion for FY2022.

The Fund estimates that Pakistan requires gross external financing of over USD 35 billion in the current fiscal year on a current account deficit of 5.3 per cent of GDP in FY2022. The IMF also raised its inflation forecasts for Pakistan to 12.7 per cent on an average for the current fiscal from the previous projection of 9.4 per cent. The CPI inflation stood at 12.7 per cent in March 2022.