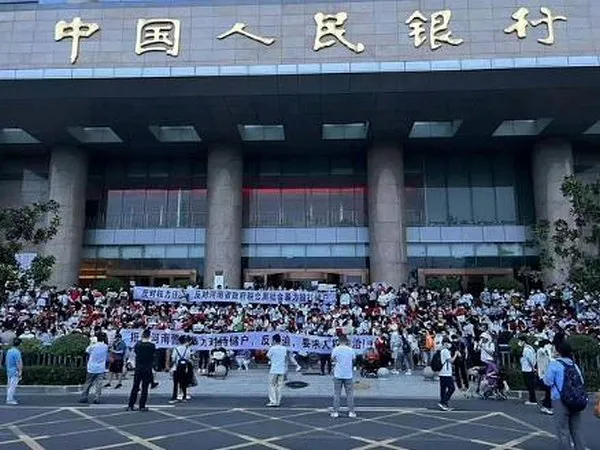

The recent protest in Henan by people who were denied access to their accounts exposed China’s “biggest bank scam”.

Hundreds of disgruntled bank customers in China have been protesting for the last two months as their accounts were frozen by four rural banks in the central province of Henan and one in Anhui, reported Financial Post.

Chinese bank scams pose threat to public confidence in the financial system. The bank scam is not an isolated or alone event or the first time in China. Bank scams are happening in China. Despite strict regulations, the country has 4,000 small and medium-sized lenders that collectively control about USD 14 trillion in assets.

However, confidence in these banks has waved since 2019, when the government seized a lender for the first time since 1998 and imposed losses on some creditors.

An official probe into the current case found that Henan Xincaifu Group Investment Holding Co, a private investment firm with stakes in the five exposed banks, colluded with bank employees to take deposits and marketed financial products via online platforms, before transferring the money by fabricating lending agreements, reported Financial Post.

Although the police had taken some suspects into custody and seized and frozen funds and assets involved in the case, widespread discount among the people still prevails.

The Chinese authorities are already grappling with shaken confidence of people in its financial system, such occurrences are only aggravating the prevailing lack of confidence.

The Chinese government of late has seen public protests more frequently due to COVID-19 restrictions and people’s protests due to loss of confidence in the financial system since April 2022 could only aggravate the situation.

As people protested against the recent bank scams, the Chinese government deployed people’s liberation Army tanks on Henan streets which according to many observers was a grim reminder of the Tiananmen Square protests 33 years ago when the student protesters were brutally attacked, reported Financial Post.

The bank scams do not anger well for the Chinese financial system as well. It has a variety of weaknesses. The breakneck speed with which shadow banking has grown in China has its own disturbing aspects.

Shadow banking in the country refers to underground financial activity that takes place outside the traditional banking regulations and systems.

China has one of the largest shadow banking industries with approximately 40 per cent of the country’s outstanding loans tied up in shadow banking activities. Economic analysts warn that shadow banking potentially poses a serious systemic risk in the long and short run, reported Financial Post.

The Chinese shadow banks have provided easy funding to the property market and real estate which has not only led to the building of more and more apartments which do not find sufficient buyers but has also pushed up housing prices due to excessive speculation.

Higher prices prevent clearance of housing inventory and bad loans build up. Investment in using constitutes more than 70 per cent of asset holding in Chinese households.

In case houses are not delivered timely or people fail to repay loans, there is certainly a systemic risk. In fact, shadow banking is held responsible for creating the real estate bubble in China which has led to an unsustainable surge in credit activity.

The fear of missing out has stocked the investors’ expectations and many people are now buying property for investment or speculative purposes, which Guo Shuqing, Chairman of the China Banking and Insurance Regulatory Commission termed as “very dangerous.”

By 2020, the household debt in China had reached 150 per cent of its disposable income. According to a Goldman Sachs report, while the total value of houses and developers’ inventory had reached USD 52 trillion in 2019, the amount actually invested in Chinese housing stood at also 1.4 trillion in June 2020.