Introduction

China’s meteoric economic rise since the launch of the Reform Era by Deng Xiaoping in the late 1970s has been increasingly accompanied by a desire to promote the international usage of the Chinese national currency, the Renminbi (RMB). RMB internationalization has been a key objective of Chinese monetary policy for well over a decade and seeks to promote the usage of the RMB in global financial transactions, reducing the dependence on mostly US-based intermediary financial institutions (Iglesias, 2016). Beijing has increasingly sought to use the RMB in high-value transactions with non-Western partners, most recently paying in RMB for the purchase of energy imports from Russia and the Gulf countries (DiPippo & Palazzi, 2023). For China, the internationalization of the RMB is viewed as a necessary component in the fostering of a more multipolar global order that treats China and Western countries, most notably the United States, as equals and reflects China’s global politico-economic role in the 21st century.

Indeed, the United States’ unique role in the global financial architecture developed following the Second World War constitutes a key push factor in China’s objective of RMB internationalization. Since 1945, the US Dollar operates as the de facto global reserve currency, with the Federal Reserve System (Fed), the United States’ central banking system, controlling the global availability of the dollar. This has provided the Fed and American administrations with the ability to function as a global lender of last resort, including in the 2008 global financial crisis. While Fed activity has historically played a key role in promoting global economic recovery in times of financial distress, Washington has also utilized its capacity to issue dollars to run up budget deficits and shape the monetary policy of other economies, eliciting repeated criticism of the ‘exorbitant privilege’ the United States enjoys due to the role of the dollar in global monetary markets (Bernanke, 2016).

This article explores how China has promoted the internationalization of the RMB, what progress has been made, and what challenges remain. The article initially discusses the global role of the dollar in financial markets, the subsequently created ‘exorbitant privilege’ for American governments and attempts of and limits to the de-dollarization of the global economy. It then moves to discussing the policy measures China has taken thus far to promote RMB internationalization. This submission finds that although China has developed an increasingly more sophisticated financial infrastructure for RMB-denominated assets, the entrenchment of the US Dollar, regulatory challenges within China, and concerns regarding government intervention have limited the global usage of the RMB.

Washington’s ‘exorbitant privilege’ and de-dollarization efforts

Coined by the French economist Valéry Giscard d’Estaing in the 1960s, the notion of the United States enjoying an ‘exorbitant privilege’ describes the idea that the post-1945 role of the dollar has allowed the US to enjoy unrivaled economic and political advantages. The dollar’s role and the peg of other national currencies to the dollar has conferred significant benefits to the United States, including lower borrowing costs, reduced exchange rate risk, and increased influence over other currencies and financial systems. The dependence on the dollar and the associated leverage for the US has led other countries, including countries mostly aligned with Washington, to push for the growing international usage of other currencies. The use of other currencies to rival the role of the dollar is broadly known as de-dollarization.

The dollar’s status as the primary global reserve currency can be traced back to the Bretton Woods System, established in the aftermath of the Second World War. As part of the global governance architecture developed during the Bretton Woods negotiations, the US$ was pegged to the value of gold, with other national currencies in turn being pegged to the US$. In effect, this made the dollar the monetary anchor of the post-1945 global financial system. Following the destabilizing effects market crashes and financial volatility had on international economics and politics in the interwar period, ensuring currency and price stability was identified as a key component in the pursuit of long-term social, economic, and political stability (Bordo, 2017). As part of Bretton Woods, the International Monetary Fund (IMF) was created to promote monetary cooperation and stability among member countries. Today, the IMF remains a key tool through which the US can pursue economic policy objectives on a global scale: as the US is the main provider of the IMF’s capital base, it holds the most voting power in the organization, allowing it to significantly shape policy decisions and directions and inform the selection of top management personnel (Gray & Kingsley, 2018). Any change in the US’ voting share in the IMF needs to be approved by Congress, leading to Congress partially being criticized as the IMF’s de facto parliament (Mohseni-Cheraghlou, 2022). The US’ role in the IMF has contributed to a perception of the IMF as an essentially Washington-led initiative that suffers from a significant democratic deficit. Both the initial peg of the US$ to gold (and the associated peg of other currencies to the US$) as well as the US’ degree of influence in the IMF’s decision-making processes grant the United States a unique advantage: the Fed remains the sole issuer of the world’s primary reserve currency and US policymakers can leverage the role of the dollar and influence over the IMF to not determine but at least inform how fiscal and monetary policy is conducted in other countries and markets.

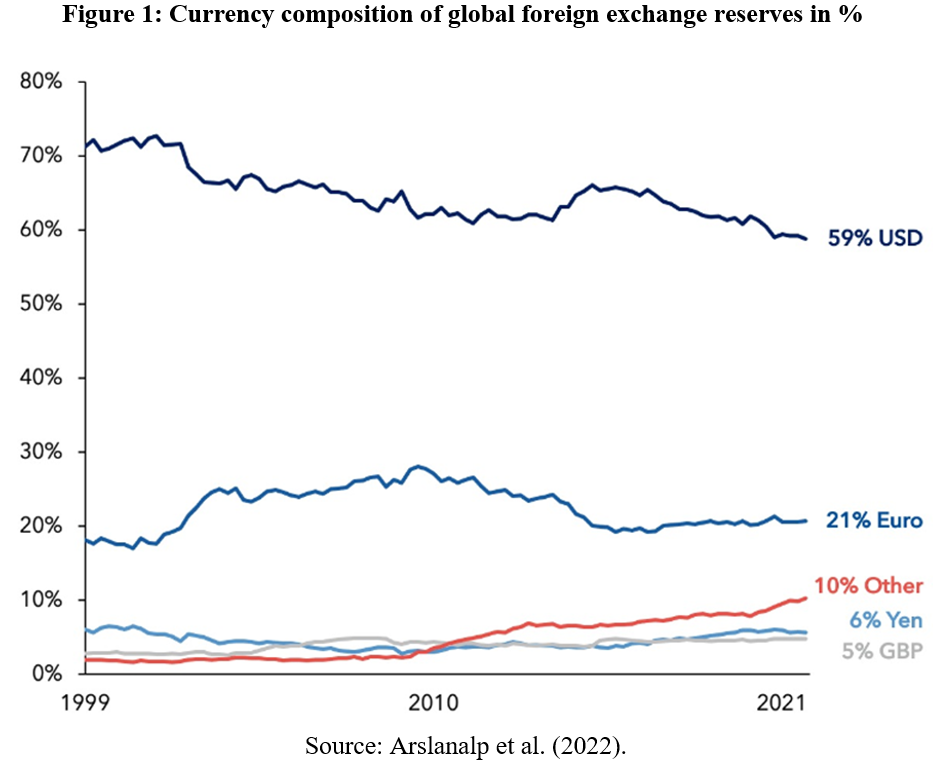

One major benefit for the US is the reduction of exchange rate risk as a result of the continued global demand for the dollar. As the dollar continues to be widely perceived as the most stable currency, foreign governments, national central banks, and commercial banks elsewhere prioritize the accumulation of dollars as savings to facilitate international trade and as a store of value. Other national and regional currencies most notably the Euro and the Japanese Yen, have come to function as additional reserve currencies. However, 59% of all global foreign exchange reserves are still held in dollars (Arslanalp et al., 2022). The continued demand for the dollar creates persistent demand for dollar-denominated assets, including US Treasury Bonds, the purchase of which lowers borrowing costs for the US, thus allowing US administrations to maintain domestic investments (Siripurapu, 2020). Crucially, this has allowed American governments to run up unsustainable and increasingly politicized public debts that would force other countries to default on their debt. The spending power generated by the dollar’s role in international financial markets has consequently been heavily criticized by the Chinese government (Steil & Smith, 2017). Further, the dollar’s role as a global reserve currency and the peg of other currencies makes the value of the dollar a benchmark for global exchange rates, providing the United States with reduced exchange rate risks in international trade and investment transactions. In contrast, other countries face greater exchange rate volatility, which can impact their economic stability and growth prospects.

In the past, Washington has selectively used the dollar’s unique currency status to pursue foreign policy objectives and exert economic pressure on other countries and private actors. The United States can use its control over the dollar as a tool for economic and financial statecraft, for instance by coordinating macroeconomic policy and investment/banking regulations while imposing sanctions on countries and/or entities by restricting their access to dollar-denominated transactions and the American financial system (Smart, 2018). As sanctioned entities are locked out from trading on US markets, they are increasingly locked out from trading globally. In the past, the US has leveraged this influence to punish foreign actors and pursue foreign policy objectives, such as addressing human rights violations, countering terrorism, and responding to (perceived) threats to US national security (Bartlett & Ophel, 2021). The use of economic sanctions has been a source of significant controversy, with criticism focusing on sanctions’ impact on civilian populations, international trade and trade openness, and potential retaliatory measures by affected countries (Sanandaji, 2018). In a financial system still largely dependent on dollar-denominated assets and securities, US-imposed sanctions can severely affect the growth prospects of national economies and selected private entities. Additionally, the United States can leverage its position to shape international financial regulations, standards, and institutions in a way that aligns with its economic and geopolitical interests. This overarching strategic advantage forms a major part of the US’ ‘exorbitant privilege’.

The role of the dollar has also contributed to the centrality of the American financial system and private entities as the major intermediary parties for international transactions. US banks facilitate most global foreign exchange transactions, clearing and settling international payments, and providing a wide range of financial services related to the international use of the dollar (Habib, 2010). This has conferred significant economic benefits to US private economic agents, including transaction fees, financial services revenue, and overall economic activity associated with global financial intermediation. US banks have also played a crucial role in the development and implementation of global payment systems such as SWIFT (Society for Worldwide Interbank Financial Telecommunication), which further strengthens the US financial system’s position in the global financial architecture. Sanctions imposed on Russian State and private entities exhibit the scope of leverage generated by the US’ position in the global financial ecosystem. Following Russia’s invasion of Ukraine in February 2022, US sanctions promptly focused on limiting Russia’s access to SWIFT to undermine Russia’s ability to use central bank reserves to prop up the Ruble in the face of Western sanctions regimes (Collins et al., 2022). This unrivaled degree of financial control is a function of the dollar’s broader role in international finance.

Over the years, many countries, including close US allies, have sought to challenge or reduce the leverage produced by the dollar by pushing for the increased use of other currencies. Some countries and regions have sought to challenge the dominance of the US$ by creating regional reserve currencies. The Euro, for example, created a currency union in which the new currency challenged the usage of the US$ for transactions among Eurozone members and between Eurozone countries and other international trading partners (Arslanalp et al., 2022). Similarly, countries in the Gulf Cooperation Council (GCC) have discussed the possibility of creating a regional currency to reduce their reliance on the dollar in regional trade and financial transactions (Low & Salazar, 2015). Russia and China have been increasing their gold reserves to diversify their foreign exchange holdings and reduce their dependence on the US$ (Nikoladze & Bhusari, 2023). The effort to trade in currencies other than the US$ is broadly known as (attempted) de-dollarization, which involves the use of other currencies for invoicing, settlement, and reserve holdings (Liu & Papa, 2022).

Efforts of de-dollarization have faced several challenges. Firstly, the dollar’s dominance in the global financial system and the role of American banks and other financial intermediaries creates a significant barrier to de-dollarization. The widespread and continued use of the US$ in international transactions has led to network effects and inertia, making it challenging to shift to alternative currencies because of the sophistication of the present ecosystem. The depth and infrastructure of dollar-denominated markets, such as bond markets and global payment systems, provide significant liquidity and efficiency, making them attractive for international transactions and providing stability to these transactions. As such, concerns about currency stability, economic size, and macroeconomic policies of the issuers of alternative currencies can impact the currency’s adoption by others in international transactions (Kokenyne et al., 2010). Geopolitical factors, including potential economic sanctions and trade restrictions, can also hinder de-dollarization efforts by exacerbating the risk of currency fluctuations. Market participants, including businesses and financial institutions, may be incentivized to continue using the US$ due to existing contracts, established relationships, and the discussed concerns regarding transaction costs and currency risks. Even between countries that converge in their skepticism vis-à-vis the dollar, de-dollarization efforts require coordination and cooperation between different actors, including agreements on currency swap arrangements, trade invoicing, payment systems, and clearing arrangements. State-to-State divergences in interests and priorities can provide a stumbling block here.

In sum, the role of the dollar as the global reserve currency and the status of American financial institutions in international transactions has bestowed the United States with a unique role in the global financial system, allowing it to run up deficits by issuing bonds and selling dollar-denominated debt. Washington’s repeated usage of the dollar as a foreign policy tool has reinforced pushes for de-dollarization. Although de-dollarization has led to a decrease in the dollar’s share in State’s foreign exchange reserves, the dollar has maintained its role as the dominant global currency (see Figure 1).

RMB internationalization

China has been actively promoting the international usage, or internationalization, of its currency, the Renminbi (RMB). Pursuing currency internationalization has been a long-standing ambition, with a 2009 pilot program being the first initiative allowing Chinese and foreign companies to settle their transactions in RMB (Lim & Qing, 2011). The push for currency internationalization is part of a broader attempt to enhance the de-dollarization of the global economy. As part of this, China seeks to elevate its global economic status and reduce the dependence on the US$ as the predominant transaction currency.

As discussed, one of the primary reasons for China’s push for RMB internationalization is to reduce the degree to which the dollar bestows the United States with significant economic and strategic advantages. China holds the world’s largest foreign exchange reserves, with China prioritizing the purchase of the US$ as the primary foreign exchange reserve currency (Yu, 2013). This exposes Chinese currency holdings to exchange rate fluctuations in the dollar, providing China with an incentive to resist inflationary pressures on the US$. This conundrum led China to support the monetary policy of the Obama administration during the global financial crisis in 2008 (Tooze, 2018). However, foreign exchange reserves held in dollar-denominated assets and securities also render Chinese savings vulnerable to shifts in US policy while maintaining and financing Washington’s spending power, including in sectors that may be detrimental to China’s long-term objectives. In the long run, a reduced dependence on the US$ and a diversification of its foreign exchange reserves would provide Beijing with greater stability and resilience in managing its foreign exchange holdings whilst reducing the US’ ability to pursue global policy objectives.

RMB internationalization also seeks to bolster China’s trade and investment relations with other countries, enhancing China’s soft power outreach. By promoting the use of the RMB in cross-border trade settlements, China aims to facilitate trade and investment flows, particularly with major trading partners in Asia, and provide incentives for countries to use the RMB in their trade transactions, both with China and one another. Abroad, the emergence of the RMB as a credible and reliable international currency would help to elevate China’s global economic status and cement its role as a sustainable, long-term alternative to the United States and the dollar. As discussed above, currency internationalization and de-dollarization remain inherently linked by the ambition to challenge US financial hegemony on a global level.

China has employed a variety of tools and strategies to promote the internationalization of the RMB in recent years. These tools include domestic policy measures and regulatory reforms, financial infrastructure development, diplomatic efforts, and the promotion of RMB-denominated financial products.

Domestically, RMB internationalization is viewed as a pathway to bolster China’s financial sector reforms and boost the international competitiveness of its financial institutions. To make its financial sector more globally competitive, China has implemented a series of liberalization reforms (Das, 2023). The enhanced usage of the RMB in international transactions would expand the international footprint of Chinese financial institutions, including banks, clearing houses, and payment systems. This would provide these institutions with improved access to global markets, customers, and investment opportunities. In the process, China would create a counterweight to the role American financial institutions continue to play in structuring global financial regimes. Furthermore, growing currency demand would translate into enhanced demand for RMB-denominated financial products, such as bonds, equities, and derivatives. This would further promote the growing sophistication of Chinese financial markets and products.

China has implemented a series of policy measures, including the introduction of currency swap agreements, to promote the use of the RMB in international transactions. One key policy step was the establishment of the Shanghai Free Trade Zone (FTZ) in 2013, which serves as a testing ground for financial liberalization and RMB internationalization. The establishment of the FTZ has been supplemented by several policy incentives, such as simplified cross-border trade and investment procedures, relaxed capital controls, and favorable tax treatments (Zito, 2014). More broadly, the FTZ aims to establish Shanghai as a long-term alternative to Hong Kong, where the collapse of the ‘one country, two systems’ system has undermined the reliability of Hong Kong as an apolitical offshore financial haven (Tang, 2020). The pursuit of bilateral currency swap agreements with other countries, in turn, allows for direct RMB currency swaps without the need for US intermediaries (Tran, 2022). These swap agreements provide greater flexibility and convenience for countries to conduct trade and investment transactions in RMB. Currently, China has signed currency swap agreements with over 40 countries, including major economies such as the EU, Japan, South Korea, and Australia (Steil et al., 2021). China has also gradually expanded the scope of the Cross-Border Trade RMB Settlement (CBTRS) program, which allows companies to settle their cross-border trade transactions in RMB (Perez-Saiz & Zhang, 2023). Swap agreements consequently play a key role in promoting the usage of the RMB in global transactions.

Beijing has further introduced policies to enhance investor access to RMB-denominated assets and securities. The Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) programs, for instance, allow foreign institutional investors to access China’s domestic capital markets and invest in RMB-denominated financial products, such as stocks, bonds, and money market instruments (Simmons & Simmons, 2020). These programs have expanded the pool of RMB-denominated financial products available to international investors and are aimed at increasing demand for and access to the RMB in global investment and financing activities. As an alternative to SWIFT, China has developed the Cross-Border Interbank Payment System (CIPS), a payment system that facilitates RMB cross-border transactions and operates outside the framework provided by SWIFT (Eichengreen, 2022). Further, China has introduced the “Bond Connect” and “Stock Connect” programs, which provide international investors with access to China’s bond and equity markets respectively and allow for RMB-denominated transactions (Mazzocchi et al., 2017). Domestic reforms have thus been a pathway for broader currency internationalization.

Moreover, China has established offshore RMB centers in major financial hubs around the world, such as Hong Kong, London, Singapore, and Frankfurt. These offshore centers serve as hubs for RMB clearing, settlement, and financing activities outside of mainland China, and facilitate RMB internationalization by providing offshore markets with liquidity, infrastructure, and expertise for RMB transactions (Shih, 2020). China has also established RMB clearing arrangements with other countries, which allows for direct clearing and settlement of RMB transactions without the need for intermediaries.

The development of RMB-denominated financial instruments also plays a key role. These policy initiatives have aimed to create a global market for RMB-denominated securities to expand the use of RMB as an investment currency and diversify China’s financial markets. Commonly known as “dim sum bonds”, RMB-denominated bonds are issued by foreign entities, including governments, financial institutions, and corporations, in offshore markets such as Hong Kong, Singapore, and London (ChinaPower Project, 2020). The issuing of dim sum bonds has allowed international investors to access RMB-denominated fixed income securities, providing them with an additional investment option and helping to foster demand for the RMB in global financial markets. The domestic equivalent to foreign RMB-denominated bonds is known as “Panda bonds”, which are issued by foreign entities in China’s domestic bond market (excluding Hong Kong and Macao) (Simmons & Simmons, 2021). The Panda bond market has been established to provide foreign issuers with access to China’s vast pool of domestic savings and to directly allow international investors to invest in RMB-denominated bonds in China. This has further expanded the availability of RMB-denominated bonds to international investors and increased the visibility and liquidity of the RMB as an investment currency.

In sum, China has utilized the offshore and onshore issuance of RMB-denominated bonds as well as the development of RMB-denominated assets to promote currency internationalization. These initiatives have aimed to create a global market for RMB-denominated securities, expand the use of the RMB as an investment currency, and diversify China’s financial markets, contributing to China’s efforts to enhance the international standing of the RMB and increase its acceptance in global trade, investment, and financial transactions.

Progress and challenges of RMB internationalization

China’s reforms have created a framework in which the RMB could play a greater role in international transactions going forward. Connected policy measures, such as currency swap agreements, have facilitated trade with China’s trading partners. The QFII and RQFII programs also allow foreign investors to access China’s capital markets and invest in RMB-denominated assets. By establishing offshore RMB markets on which RMB-denominated financial products can be traded, China has also provided international investors with access to RMB-denominated assets and helped to create a global market for RMB securities. China has further promoted the use of the RMB in multilateral initiatives in which China plays a key and partially leading role, including the Asian Infrastructure Investment Bank (AIIB) and the Belt-and-Road Initiative (BRI) (Gjoza, 2018). These initiatives have facilitated RMB-denominated financing for infrastructure projects and trade-related activities in the region, bolstering the use of the RMB in global transactions. While this has not allowed the RMB to challenge the US$ as the global reserve currency, it has created a structure in which trading in RMB has become more accessible and attractive for economic agents.

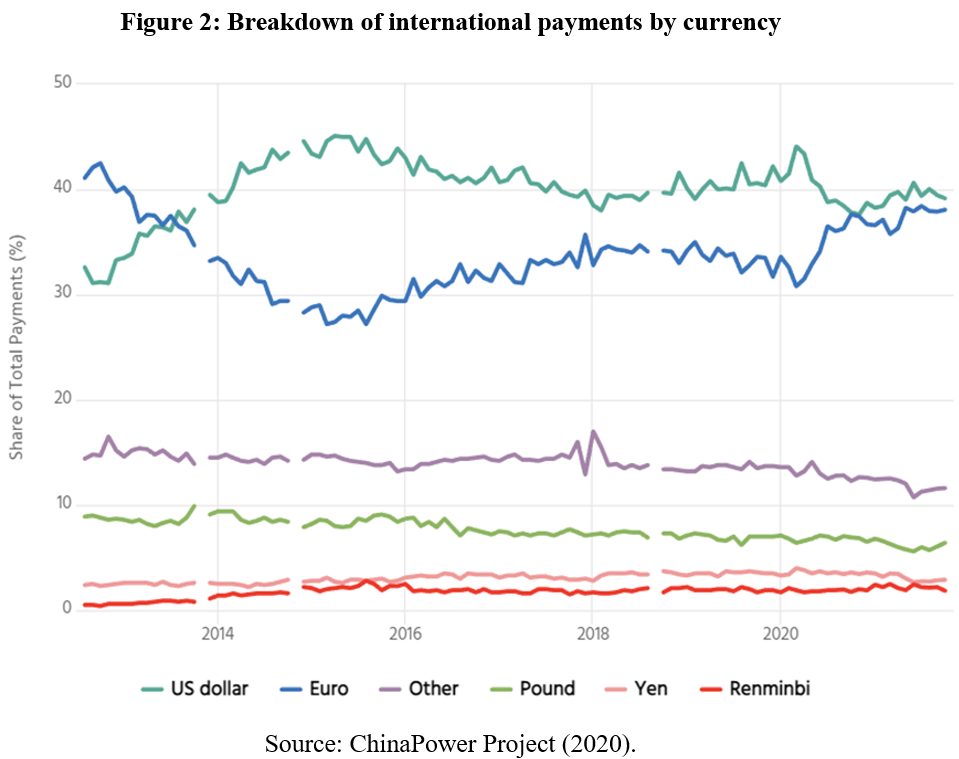

While the use of the RMB in international transactions has increased over the past decade, its use still lags behind other major international currencies. According to SWIFT (2022), the percentage of RMB-denominated international payments increased from 1.86% in 2014 to 2.31% in 2015 before falling to 1.68% in 2016. Since then, the percentage has remained relatively stable, hovering between 1.61% and 1.76%. In trade finance, accounting for the financing of imports and exports, the use of the RMB has also decreased in recent years. In 2014, RMB usage in trade finance stood at 8.66%, but by 2021, the rate had fallen to 2.96%. These numbers indicate that the RMB continues to face significant challenges in gaining wider acceptance in comparison to the dollar, the euro, and the yen (see Figure 2).

This continued lack of acceptance is partially the outcome of prevailing political concerns, including China’s human rights record. China still largely maintains strict capital controls that limit the convertibility of the RMB and restricts the free outflow of the RMB beyond Chinese borders (Huang & Lynch, 2013). These controls can hinder the use of the RMB in cross-border transactions as investors may face challenges in repatriating their investments and companies may face restrictions in remitting profits and dividends overseas. Crucially, the presence and imposition of capital controls makes RMB-denominated assets vulnerable to government policy processes that often remains untransparent and increasingly unpredictable for international investors (Harvard Law Review, 2023). This uncertainty for investors and businesses is exacerbated by fluctuations in the exchange rate. Indeed, exchange rate modification has been a key policy tool for the Chinese government in the past, leading to concerns about potential intervention risks and an overarching lack of exchange rate transparency. This can impact the willingness of international investors to hold RMB-denominated assets. The offshore RMB market, while growing, additionally still lacks the depth and liquidity of major global currencies like the dollar and the euro. This can limit the attractiveness of RMB-denominated financial products to international investors as investors face challenges in buying and selling acquired assets in large volumes. This can depress the overall demand for RMB in international transactions.

More generally, China’s regulatory environment continues to be a major impediment for enhanced RMB internationalization. Regulatory structures within China remain highly complex, with various internal actors exerting frequently diverging regulatory pressures on fiscal and monetary policy (Qian, 2023). This creates challenges for international investors and businesses in navigating the regulatory landscape and complying with local regulations. The lack of clarity and consistency in regulations may impact the confidence of international investors in using the RMB for cross-border transactions. On top of that, geopolitical tensions and uncertainties, such as trade disputes with the United States and organizational-cultural differences between China and other countries, China’s human rights record and autocratic power-system, can impact the progress of RMB internationalization. These factors can lead to changes in trade policies, tariffs, and other trade barriers, which may affect the demand for RMB in cross-border transactions. Additionally, geopolitical tensions can also impact the perception and trust of the RMB as an international currency, negatively affecting its adoption by other actors.

Despite the reforms, China currently also lacks the financial infrastructure to compete with more established currencies. The dollar and the euro remain dominant global currencies that have well-established infrastructure, liquidity, and regulatory frameworks, making them the preferred choices for many global transactions, with the RMB still playing a relatively marginal role in foreign exchange holdings (as suggested in Figure 1 above). Overcoming the dominance of these currencies and establishing the RMB as a viable alternative requires overcoming significant competition with currencies that are viewed as stable and secure long-term investments. As part of this, the perception of the RMB as a controlled currency, influenced by China’s economic and political system and the economic and strategic objectives of the Chinese leadership, may impact its acceptance and usage in international transactions. As discussed, concerns about government intervention, regulatory changes, and restrictions on capital flows provide a major stumbling block to a broader adaptation of the RMB in international transactions and have restricted the degree to which the RMB is used in international payments. The persistence of these concerns will likely shape the (un-)willingness of international businesses and investors to adopt the RMB in their future cross-border transactions.

While the internationalization of the RMB has made significant progress, it continues to face several challenges. Capital controls, currency risks, market liquidity, regulatory issues, geopolitical factors, competition from established currencies, and perceptions of the RMB as a controlled currency are among the key challenges that China needs to address to further promote the global use of the RMB. Overcoming these challenges will require continued efforts by China to deepen its financial markets, enhance regulatory transparency, and build trust among international investors and businesses in the RMB as a reliable currency for cross-border transactions. Considering the ongoing attempts to reassert Party control over various processes within China, these regulatory modifications are unlikely to be implemented in the foreseeable future.

Conclusion

This article has discussed China’s ongoing attempts to promote the international usage of the RMB, finding that regulatory challenges and long-standing concerns regarding Chinese monetary policy and the entrenchment of the dollar have restricted the degree to which other countries are using the RMB in international transactions. As with other previous and contemporary de-dollarization initiatives, China’s push for currency internationalization seeks to promote China’s role in the financial system and reduce the extent to which the United States can leverage the dollar as a geopolitical tool. In its push for internationalization, China has developed an increasingly sophisticated financial infrastructure that allows for the growing use of RMB-denominated assets and financial tools in international transactions. Yet, the RMB competes with both the dollar and the euro, both of which have thus far maintained a mostly unassailable role as global reserve currencies. So far, the success of China’s efforts of currency internationalization are more comparable to that of the Yen, which struggled to obtain a more dominant international role in the 1990s (Kwan, 2012).

Indeed, the increasing degree to which government control is once again prioritized within China makes it unlikely that China can implement the reforms required for an improved internationalization of the Renminbi.

.efsas.org