If there is one thing that riles China, it is the Taiwan connection. If any country has ties with Taiwan, it certainly gets the goat of the Chinese Communist Party (CCP). For all its penetration of South America, the one country that has maintained ties with Taipei is Guatemala. It is is one of the eleven countries around the world which still officially recognise Taiwan. Much as it has wanted, China’s growing influence appears to have met some with some pushback in Latin America. Recently, China has targeted Guatemala and outraged retailers in Brazil. Just as the rest of world woke up to the reality of China’s neo-imperialism, Latin America has just begun to pushback and its effects are beginning to be felt.

Guatemalan exporters were recently surprised when China banned the import of Guatemalan coffee and other goods. While there was no official explanation, the Guatemalan President Bernardo Arevalo, presumed that there was a connection to his country’s ties with Taiwan in the decision by China to ban the import of goods. He later claimed that his government “will take care of it”. Apart from Paraguay, Guatemala is now the only Latin American country that has diplomatic ties with Taiwan. The blockade of Guatemalan goods is one of several minor conflicts beginning to overshadow China’s course in Latin America, which has long been oriented toward promoting China’s interests in the region. Those conflicts were, however, of a different nature, and in this case, China clearly uses something as leverage, and it does this less against Guatemala, and more against Taiwan.

In February this year, the Guatemalan Foreign Minister Carlos Ramirez Martinez had hinted that his country was considering establishing formal trade ties with China. He noted that this would be done while continuing to pursue formal ties with Taiwan. President Bernardo Arevalo assumed office in mid-January, vowed to put an end to corruption, and also establish relations with China. At that point he had said, “We are interested in approaching them to try and develop some relationship around trade,” adding this could materialize as an “office of trade interests” that would help find a Chinese market for Guatemalan products. But relations soured soon thereafter over Taiwan and the latest episode is a consequence of Guatemala’s Taiwan connection. China regards Taiwan as part of the People’s Republic of China. Both Honduras and Nicaragua, in recent years, have switched sides, turning their backs on Taiwan and seeking rapprochement with China.

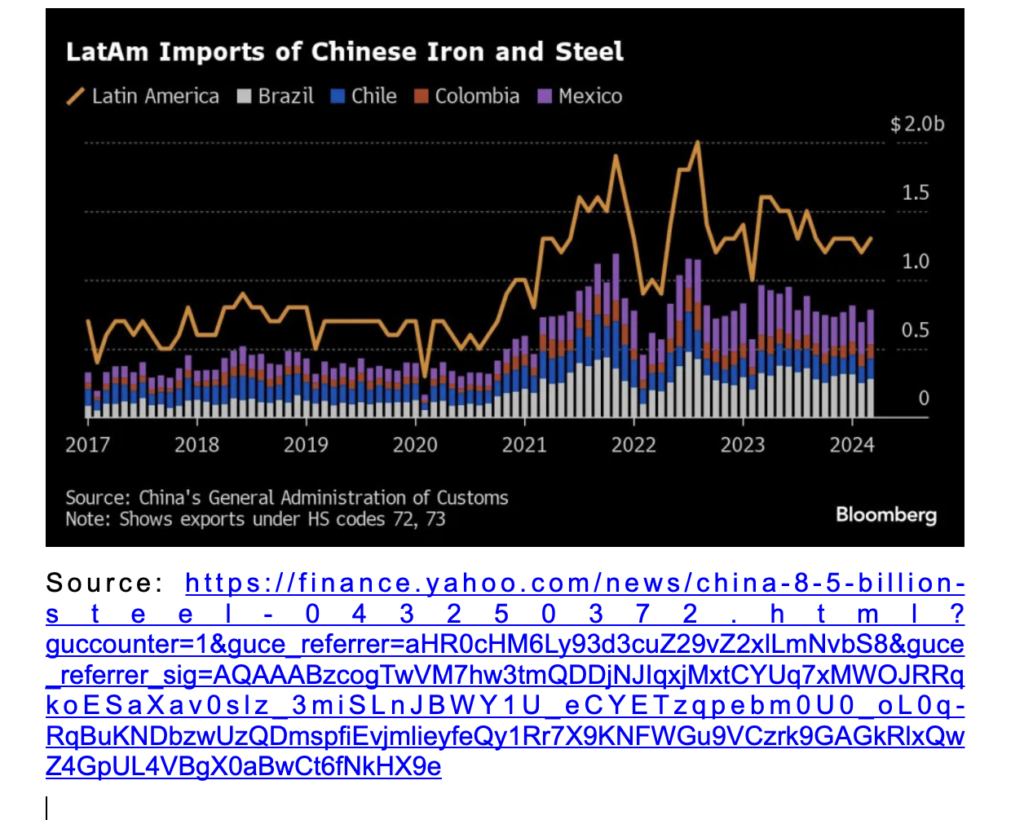

There are other examples of conflicts between China and Latin American countries. One of them involves cheap steel imports from China, which puts Latin American steel producers under pressure, thus sparking local anger. Mexico, Chile, and Brazil have raised tariffs — even doubling in some cases — on Chinese steel to protect domestic firms. The new duties come after domestic firms announced massive layoffs due to lack of demand. The taxes may seem out of turn, given how China has entrenched itself in Latin America in recent years. China has become the biggest buyer of raw materials from the region and a major investor. At the same time, China is sending nearly 10 million tons of steel a year, valued at US$ 8.5 billion, to Latin America, a huge jump from a mere 80,500 tons in 2000.

Meanwhile, in Brazil, cheap textiles from China are posing a serious threat to local fashion boutiques. Accusations against Chinese companies causing environmental damage with their operations have also sparked debate. Brazil is fighting back against cheap Chinese imports by imposing a 20% tax. This affects goods valued under US$ 50 which are bought via international shopping websites. At the grassroots level, there’s a growing feeling that China’s strategy destroys local trading structures rather than making them profitable. Chinese online retail platform AliExpress said it was “surprised” by the decision, as the tax would primarily hit the poorest and discourage foreign investment in Brazil. In the Brazilian textile industry, considerable anger has been directed at Chinese suppliers, because conglomerates such as Shein, which don’t produce their goods under the same conditions and general framework as small Brazilian firms, are pushing thousands of local companies out of the market.

Another instance of the China factor coming into play occurred in Costa Rica, where the government urged one of the managers of state-owned energy supplier ICE to leave the company after some 70 high-ranking employees had visited a party organized by Chinese technology giant Huawei. Relations between Costa Rica and Huawei became strained after President Rodrigo Chaves said the Budapest Convention on Fighting Cybercrime, which China has not signed, would be the standard for economic engagement with Costa Rica. Afterwards, Huawei’s chief executive for Latin America criticized Costa Rica’s approach as “unprofessional.” This is a message for Beijing that “China has to play by the rules as well”. The Budapest Convention is the first international agreement (2004) on crimes committed on the internet. Focus areas are copyright infringements, computer-related fraud and violations of network security.

In recent years, the US has also been concerned over China’s growing influence in Latin America. A few Chinese projects have rankled the US Administration. Recent news about potential setbacks for two of those projects, a space-monitoring station in Argentina and a megaport in Peru, point to US attempting to play a counter-balancing role in Latin America. The space-focused station, the first of its kind outside China, spans about 494 acres and benefits from tax and customs duty exemptions for 50 years. The facility operates within a exclusion zone of approximately 62 miles, and where access requires authorization from the Chinese government!

Recently, the challenges and risks related to China as a dominant actor in several areas of the economy and technology have become more and more apparent in Latin America. Various countries are increasingly feeling that it’s predominantly China which has profited from the region’s economic relations with China. Therefore, it is anticipated that current criticism of China’s trade practices could become even more pronounced. That the pushback has begun is an indication that China’s expansion in Latin America could well slow down in the coming years.