The Chinese military is about to buy semiconductors designed by American companies and manufactured in Taiwan and South Korea to boost its advances in artificial intelligence (AI), according to a new report.

People’s Liberation Army (PLA) makes “significant progress” in adapting AI to its combat and support technologies, according to the June report (pdf), published by The Center for Security and Emerging Technology at Georgetown University (CSET).

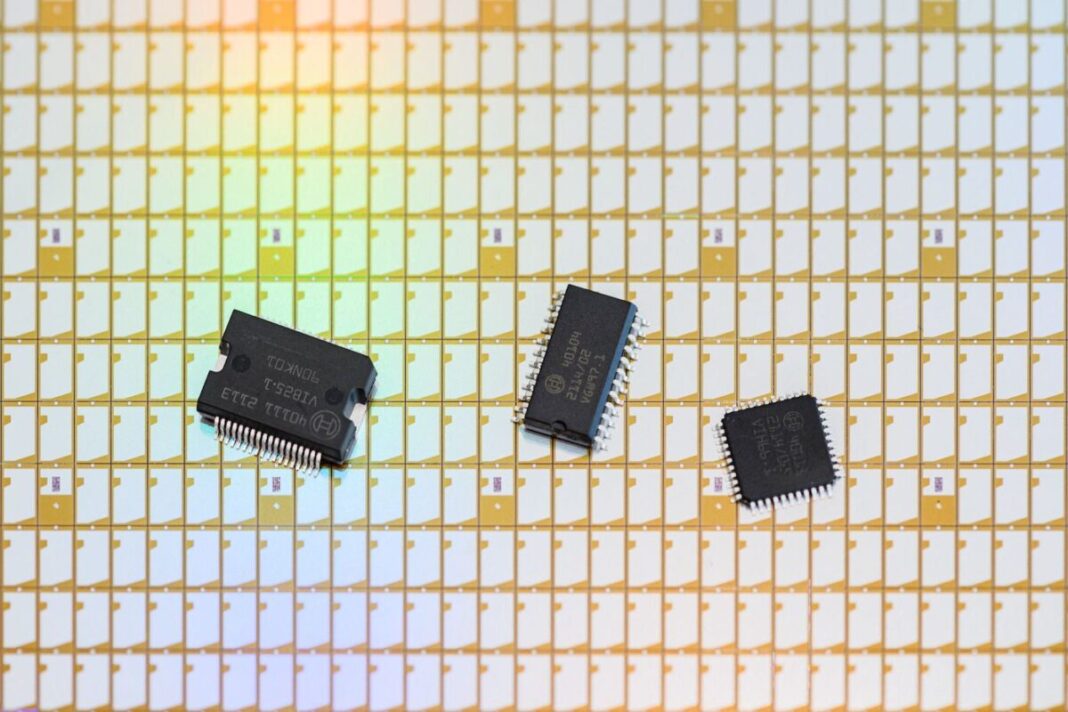

Through an analysis of 66,000 public contracts issued by the PLA, the authors of the report found only 24 that dealt with the purchase of the types of high-end chips used for AI applications, the vast majority of which were U.S. designs.

“Despite more aggressive efforts by the Trump and Biden administrations to curb technology “exports to the Chinese military, PLA orders AI chips designed by US companies and manufactured in Taiwan and South Korea,” the report said.

“Of the 97 individual AI chips we could identify in public PLA purchasing registers, almost all of them were designed by Nvidia, Xilinx (now AMD), Intel or Microsemi.”

CHINA DEPENDING ON THE HIGH-END U.S SEMICONDUCTORS

The PLA has been steadily evolving in the field of artificial intelligence since 2017, when China’s Communist government published “New Generation AI Development Plan.” This document outlined the regime’s plan to achieve global dominance in artificial intelligence by 2030.

In pursuit of this goal, the PLA has sought to expand and improve its AI capabilities, but its ability to train its own advanced machine learning systems is currently dependent on access to top-tier semiconductors designed by U.S. companies, according to the CSET report.

Of the 97 AI chips explicitly listed for purchase among the PLA contracts, only one originated from China’s Fudan Microelectronics, and one was a clone of an American design.

“We searched for, but could not find, any records of PLAs or Defense State-owned companies (SOEs) that awarded contracts for Chinese-designed AI chips … In fact, while most of the contracts that mention these companies , was for CPUs and other processors, none were for AI chips, “the report said.

This discrepancy provides new insights into how much China’s military relies on US products to conduct its most advanced research. However, this is not the first time that US-designed chips have found their way into the regime’s state security apparatus.

NOT THE FIRST TIME FOR AMERICAN CHIPS IN CHINA

Both Intel and Nvidia were caught in controversy in 2020 when it was uncovered that corporate chips were used by the Chinese Communist Party (CCP) to run its huge surveillance program in Xinjiang, where over a million Muslim ethnic minorities have been detained in concentration camps.

A previous CSET report (pdf) also found that Intel had completed research with the Chinese company 4Paradigm at the same time as the company had an open contract to develop AI decision-making software for PLA.

The Victims of Communism Memorial Foundation, a Washington-based advocacy group, went as far as to say that Intel provided “direct support” to the PLA and accused, among other things, the company of supporting “Beijing’s military modernization, surveillance state, domestic securitization and accompanying human rights violations.”

The emergence of Intel and Nvidia’s technologies at the heart of PLA’s AI research thus serves as another example of how technologies developed by US companies are supercharging The CCP and its military development through large-scale technology transfer.

The report also sheds light on how China’s communist regime is able to continue to acquire quasi-legally groundbreaking technologies by exploiting frontline organizations to make purchases on its behalf when it is barred from doing so directly.

As an associated CSET fact sheet (pdf) on the highlighted question: “These unprecedented cases prove that the Chinese military uses intermediaries to access US-designed AI chips to support their military modernization.”

CHINA’S MILITARY IS AN END USER OF US SEMICONDUCTORS

The CSET report also underscores a vital tension at the heart of US export policy and China’s technological progress. The regime’s emphasis on so – called “dual use” technologies that can be used for both civilian and military uses, combined with its military-civilian fusion policy, means that all exports of such technologies to mainland China may well be exploited by the PLA. .

Despite this risk, the report notes that the $ 600 billion global semiconductor market means that U.S. technology companies are unlikely to slow down the flow of such technology on their own.

This is somewhat of a problem given that the US government is currently restricting its exports based on end-user controls, which effectively means that it cannot realistically prevent the Chinese military from procuring high-end chips through a third party.

To that end, the authors of the report suggest that the United States implement more demanding export controls that focus on the physical and technical properties of the chips themselves, rather than the intended applications and end users of the chips.

“In each case, PLAs and state-owned defense companies awarded contracts for US-designed chips to Chinese intermediaries,” the report said.

“Effectively curbing Chinese military advances in artificial intelligence and other cutting-edge technologies will require the U.S. government to adopt new and creative forms of export controls that go beyond the current focus on visible end users and end users.”

Only through a change in the specifications on which export controls are built could the United States adequately combat the fact that the PLA was an end user of American semiconductors in all but name.

“It is worth repeating that none of the seven PLA AI chip vendors identified in this study are named on either the US Entity List or the Military End User List,” the report said.

“Congress should approve, and the Ministry of Commerce should create, a multilateral export control system based on the physical and technical characteristics of technologies exported to China, including high-end semiconductors.”