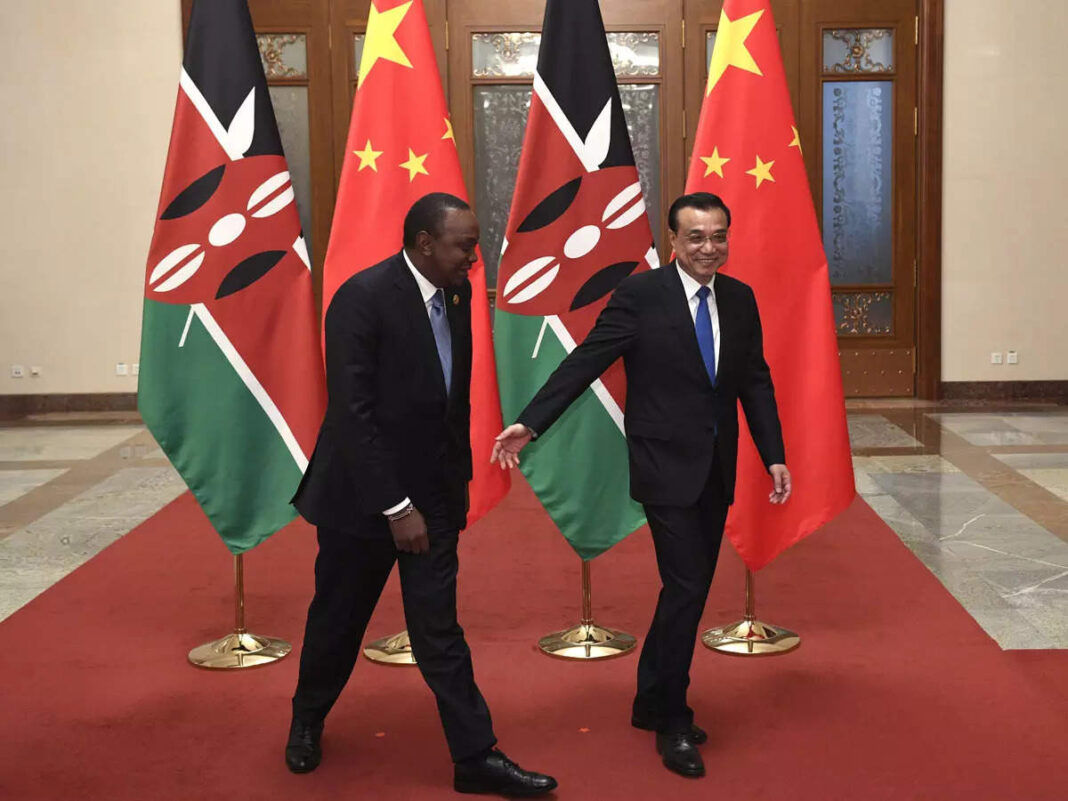

The Kenyan government has shown increasing appetite for Chinese funding for its large-scale infrastructure projects without probably considering the long-term economic implications for the same. Although Kenya’s President Uhuru Kenyatta has defended the country’s strategy, many Kenyans have alleged that the China funded projects are secretive, high cost and debt creating. While these projects have put extra burden on the people, these state assets are at risk due to failure in debt servicing. The present case in point is Nairobi Expressway (estimated cost: $668 million).

The 27-km highway aims to link the Jomo Kenyatta International Airport (JKIA) to the Nairobi-Nakuru highway and cut travel time from the south to west of Nairobi to about 20 minutes from two hours during the peak time, according to informed sources. The expressway that is under construction is funded by China Road and Bridge Corporation (CRBC) under a public-private partnership. To manage the operations, Moja Expressway Company (subsidiary of CRBC) has been established which is mandated to maintain the expressway for 27 years and collect toll fees as per the pay-for-use basis.

The CBRC is expected to earn $977 million as dividend and other incomes from the mega road, claimed above mentioned sources. CRBC through its local arm Moja Expressway Company will collect an estimated Sh3.9 billion (local currency) annually or 35 % of revenues generated from toll fees charged to motorists, according to sources.

The China funded expressway project is apparently being criticized not only for high cost but also for planning to charge arbitrarily high toll charges from Kenyans. According to experts, the motorists will pay $2.61 billion over a period of 27 years for using 27-Km long expressway. Many Kenyans are reportedly resentful of this fact. Besides the amount would be paid in US dollars, that may further exacerbate the inflation in the country. Many locals find it strange that the Kenyans would have to pay in dollars. Given the continued depreciation of the local currency and the rising inflation the actual amount of toll paid by the Kenyans would be much higher than the initial estimate. Even though the Kenyan government had defended the construction of the Expressway, stating that it would improve the economy of the country, most Kenyans are critical of the fact that money from the expressway tolls would all go to the CRBC for twenty-seven years until the ‘debt’ was paid off.

The Chinese companies pay scant attention to environmental impacts while implementing infrastructure projects and Chinese funded Kenyan projects are not an exception. The environmentalists in Kenya have argued that the massive cutting down of trees to implement the project could damage the local climate. According to media reports, some 4,000 young and mature trees are being cut down to make way for the expressway. The Chinese allegedly bribed their way through in Kenya and CRBC had been found involved in corrupt practices in other countries as well, sources alleged.

The CRBC which is constructing the Kenyan expressway had been ‘debarred’ by the World Bank in 2009 for engaging in corrupt practices in the Philippines. The anxieties of Kenyan people about large-scale infrastructure development, overwhelmingly financed and built by China, is exacerbated due to apprehension of a debt trap. In September 2021, Kenyan State Department of Labour had failed to pay China Jiangxi for work on a shopping mall. Before this in July 2021, the Kenyan government was forced into compensation negotiation after cancelling a proposed airport terminal project. There are also concerns regarding takeover of the Mombasa Port by the Chinese developer if Kenya fails in repayment, although Beijing has denied any such clause in the contract.

These concerns resonated with other wider anxieties such as displacement, adverse economic and ecological impacts, the issue of livelihood, rising external debt, and lack of transparency in the proposed and existing projects built by the CRBC and other Chinese companies. Kenyans see the Chinese projects as ‘elusive development’ as these projects are not benefitting the majority of people. Kenya is reportedly looking forward for Chinese funds to realize its 5-year (2017-22) Action Plan. About 107 Chinese firms are reportedly operating in the country and it is becoming increasingly difficult for Kenya to service the Chinese debt and interest. China owns around 72% of Kenya’s total external debt of $50 million. Moreover, Kenya’s trade balance with China is negative due to its over-dependence on Chinese exports. This adds pressure on the Kenyan Shilling which, in turn, worsens Kenya’s overall debt burden.